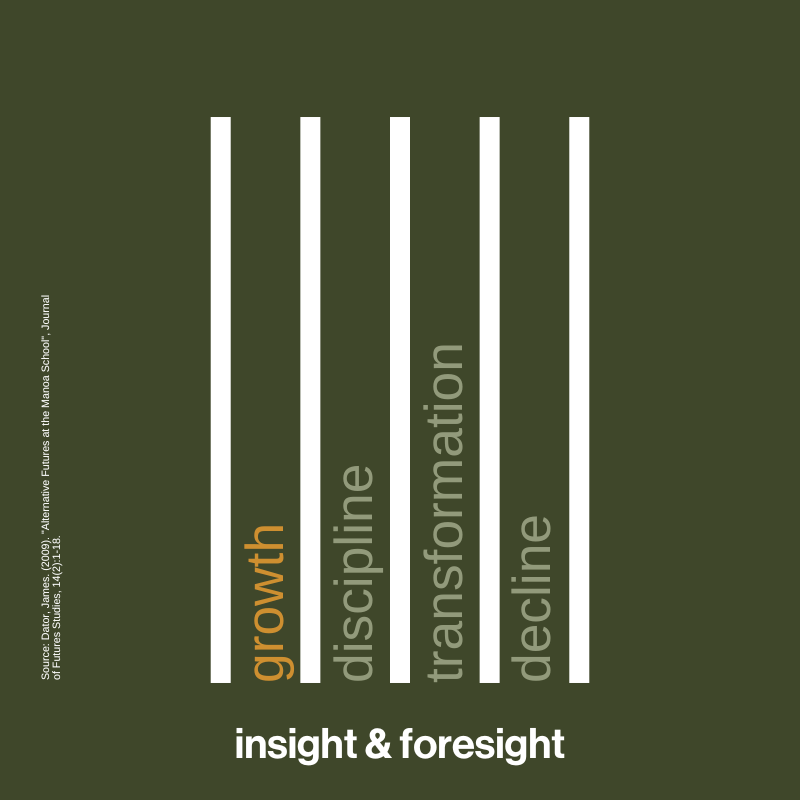

Futures Thinking Icon No. 4: Four Archetypes.

A visual of Jim Dator’s Four Archetypes showing 5 lines defining 4 spaces or lanes - one for each archetype.

This article is part of our Icons of Futures Thinking.

Applying Jim Dator’s Four Scenario Archetypes to Strategic Foresight.

Futures thinking helps leaders move beyond short-term forecasts and build resilient strategies under uncertainty. Rather than predicting a single outcome, it frames multiple, plausible futures—each with distinct risks, opportunities, and strategic choices. One of the most useful and widely taught frameworks for doing this comes from futurist Jim Dator: four scenario archetypes that describe recurring patterns of change—Growth, Discipline, Transformation, and Decline.

This post explains each archetype, shows how to apply them in strategic planning, policy-making, and organisational development, and offers practical steps to integrate them into your decision-making. You’ll walk away with a structured way to challenge assumptions, improve scenario reliability, and strengthen strategic agility.

Key Takeaways:

Dator’s archetypes create a balanced set of alternative futures—useful across industries and regions.

Each archetype reveals different strategic options, investments, and governance choices.

Using all four archetypes reduces blind spots, improves leadership alignment, and increases decision agility.

What is Futures Thinking—and why does it matter now?

Futures thinking (AKA strategic foresight, foresight, strategic thinking) equips leaders to explore how change could unfold, not just how it’s trending today. It blends qualitative exploration with quantitative signals—trends, weak signals, technological developments, regulatory shifts, and social change—to build scenarios that challenge “business as usual.”

The goal isn’t prediction. It’s preparedness and adaptability, asking;

"What would we do if this did happen?".

By rehearsing multiple futures, leadership teams stress-test strategy, identify leading indicators, and make more confident bets. Dator’s archetypes can streamline this process by offering four distinct, comprehensive pathways any system might take.

Dator’s Four Scenario Archetypes at a Glance.

Growth: Continued expansion—more of the same, faster. Economic growth, technological diffusion, rising consumption, and productivity gains dominate.

Discipline: Managed constraints—values, rules, or resource limits shape and slow growth. Stability, equity, and sustainability guide choices.

Transformation: Disruption resets the system—breakthrough technology, social reordering, or institutional redesign creates a qualitatively different world.

Decline: Systemic breakdown—instability, fragmentation, or collapse reduces capacity and undermines previous gains.

Together, these create a complete set: plausible, contrasting futures that pressure-test strategy from all angles. Let’s explore each scenario archetype:

Archetype 1: Growth

Growth imagines continuity with positive momentum. Markets expand, innovation compounds, and consumer demand keeps rising. Organisations optimise for scale, speed, and reach.

Signals and Drivers:

Strong capital flows into emerging tech and infrastructure

Productivity gains from AI and automation

Stable policy environments favouring innovation and trade

Growing middle classes in developing regions

Strategic Implications:

Scale up core offerings and invest in capacity

Accelerate product development cycles and partnerships

Expand into new markets with tested business models

Develop M&A pipelines to consolidate advantages

Use Cases:

Strategic Planning: A global manufacturer bets on electrification demand rising 15% YoY, investing in smart factories and supply chain visibility tools.

Policy-Making: A national government sets pro-innovation regulations to attract clean-tech investment and talent.

Organisational Development: HR builds leadership pipelines for rapid growth, focusing on cross-border collaboration and product-led growth capabilities.

Risk Watch:

Overconfidence in demand curves

Underestimating political backlash or regulatory headwinds

Supply chain fragility masked by near-term performance

Leading Indicators to Monitor:

Capital investment trends, export volumes, and R&D intensity

Customer acquisition costs and retention rates

Regulatory sentiment analysis across priority markets

Archetype 2: Discipline

Discipline assumes the system hits constraints—ecological limits, social expectations, geopolitical pressures, or cultural values—that reshape what “good growth” looks like. It emphasises rules, standards, and stewardship.

Signals and Drivers:

Binding climate targets and carbon pricing

Data protection, safety, and AI governance regimes

Resource scarcity (water, energy, critical minerals)

Social licence and stakeholder pressure on externalities

Strategic Implications:

Pivot from volume to value; focus on efficiency and resilience

Redesign products and supply chains for circularity

Invest in compliance, auditability, and transparent reporting

Build capabilities in risk, ethics, and stakeholder engagement

Use Cases:

Strategic Planning: A consumer goods company shifts from plastic-intensive packaging to closed-loop systems, winning procurement contracts tied to ESG performance.

Policy-Making: City planners prioritise public transit, dense housing, and nature-based solutions to meet emissions budgets and resilience goals.

Organisational Development: Finance and operations teams integrate carbon accounting into capital allocation and pricing models.

Risk Watch:

Margin pressure from compliance costs

Innovation slowdown if rules become rigid or fixed

“Greenhushing” and reputational risk from inconsistent disclosures

Leading Indicators to Monitor:

Regulatory calendars, standards adoption rates, and enforcement trends

ESG-linked financing costs and insurer risk models

Resource price volatility and availability

Archetype 3: Transformation

Transformation envisages deep, systemic change: technological breaks, new institutional logics, or shifts in social contracts. Think AI-native business models, programmable economies, synthetic biology breakthroughs, or decentralised governance.

Signals and Drivers:

Step-change performance in AI/automation, quantum, or biotech

New market infrastructures (digital identity, tokenised assets, smart contracts)

Social movement-driven shifts in norms and labour markets

Institutional redesign following legitimacy crises

Strategic Implications:

Launch exploratory ventures and option bets

Build modular, platform-ready architectures

Create change-friendly governance that can sunset legacy assets

Cultivate talent for emergent disciplines and hybrid roles

Use Cases:

Strategic Planning: A financial services firm builds an embedded-finance platform, integrating AI risk assessment and programmable payments into partner ecosystems.

Policy-Making: Regulators pilot sandboxes for AI in healthcare, balancing innovation with safety and oversight.

Organisational Development: A legacy enterprise creates a venture studio and ring-fenced funding to incubate disruptive business models without legacy constraints.

Risk Watch:

Over-indexing on hype cycles

Core cannibalisation without viable replacement earnings

Public trust failures due to opaque systems or bias

Leading Indicators to Monitor:

Adoption curves beyond pilot phase

Interoperability standards and developer ecosystem growth

Public sentiment, legal precedents, and safety benchmarks

Archetype 4: Decline

Decline explores turbulence and contraction—economic shocks, institutional decay, climate impacts, or conflict driving fragmentation and reduced capacity. It’s not a failure scenario; it’s a stress-test for continuity under strain.

Signals and Drivers:

Supply shocks, stagflation, or sovereign debt crises

Critical infrastructure failures or chronic climate disruptions

Talent flight and political instability

Disinformation and governance erosion

Strategic Implications:

Prioritise resilience, liquidity, and essential services

Localise supply, diversify inputs, and build redundancies

Strengthen security, continuity planning, and incident response

Maintain stakeholder trust with clear crisis communications

Use Cases:

Strategic Planning: A healthcare network builds surge capacity, distributed inventories, and cross-training to maintain care quality in prolonged emergencies.

Policy-Making: Governments invest in grid hardening, water resilience, and civil defence to limit cascading failures.

Organisational Development: Leadership drills scenario-based crisis playbooks and pre-positions authority for rapid decisions.

Risk Watch:

Paralysis and underinvestment in future opportunities

Talent burnout and cultural erosion

Over-correction that raises long-term cost structures

Leading Indicators to Monitor:

Credit conditions, supply lead times, and default rates

Infrastructure incident data and climate risk projections

Workforce engagement and retention metrics

How to Use the Archetypes in Practice.

1) Build a baseline and four contrasting scenarios

Start with your current strategy and assumptions.

Develop four scenario narratives—one for each archetype—anchored in your industry and region, using evidence and signals.

Keep them plausible, internally consistent, and sharply distinct.

2) Quantify impacts

Map revenue, cost, and risk implications under each scenario.

Identify key drivers: demand, unit economics, regulation, input prices, and talent availability.

Use ranges and stress tests instead of point estimates.

3) Define strategic options and no-regrets moves

Options: targeted bets that could pay off big in certain futures (e.g., hydrogen supply partnerships; digital twins for manufacturing).

No-regrets: moves that help in most futures (e.g., data architecture upgrades; supplier diversification; leadership upskilling).

4) Establish signposts and tipping points

For each archetype, set leading indicators and thresholds that suggest it’s gaining probability.

Define “if this-then” triggers to accelerate or pause investments based on signal movement.

5) Align leadership and governance

Use scenario workshops to surface assumptions and trade-offs.

Document decision rights, escalation paths, and capital allocation rules that adapt as signposts shift.

Revisit scenarios quarterly or when material conditions change.

Cross-Industry Examples:

Energy and Resources:

Growth: rapid renewables deployment with storage scale-up; global demand rises.

Discipline: carbon budgets constrain upstream projects; focus shifts to efficiency and grid stability.

Transformation: fusion breakthroughs or long-duration storage rewire markets.

Decline: supply shocks and extreme weather cause rolling shortages; microgrids surge.

Financial Services:

Growth: embedded finance and wealth expansion; cross-border flows increase.

Discipline: tighter capital rules, AI model audits, and consumer protection reshape product design.

Transformation: tokenised assets and programmable money enable real-time settlement and new collateral models.

Decline: credit stress, liquidity crunches, and fraud spikes; capital preservation dominates.

Healthcare:

Growth: scalable telehealth, biomedical devices, and preventative care ecosystems.

Discipline: outcome-based reimbursement and safety regimes; data sovereignty controls.

Transformation: AI-driven diagnostics and personalised therapies; synthetic biology accelerates R&D.

Decline: system strain from pandemics or climate events; essential services and local manufacturing take precedence.

Challenging Assumptions with Alternative Futures.

Leaders often default to a single storyline—a smooth Growth curve or a feared Decline. Dator’s archetypes force a balanced set:

They counter confirmation bias by exploring futures that break current trends.

They build strategic flexibility by revealing options that are invisible in a single forecast.

They improve scenario reliability by using a structured typology grounded in recurring patterns of change.

Crucially, the framework supports a global, inclusive view. It accommodates different cultural values (Discipline), technological pathways (Transformation), development stages (Growth), and systemic risks (Decline), making it relevant across markets and sectors.

Practical Toolkit: from insight to foresight to action.

Workshop Agenda (full-day):

Brief on external trends and weak signals - also provided as pre-reading (60 minutes)

Breakouts: build four short scenario narratives (90 minutes)

Plenary: identify top 5 risks and opportunities per archetype (90 minutes)

Option portfolio design: no-regrets, targeted bets, hedges (60 minutes)

Signposts and triggers: define metrics, thresholds, and owners (60 minutes)

Artefacts (AKA Souvenirs) to Produce:

One-page scenario cards with implications and signposts

A decision matrix linking investments to scenarios

A dashboard tracking indicators and trigger statuses

Governance Tips:

Assign executive sponsors to each archetype to avoid bias

Tie a portion of capital allocation to option bets

Review signposts alongside financial KPIs in monthly ops meetings

Check out the insight & foresight Futures Thinking Engagement Framework for more details on how to develop scenario building capability.

Making Better Decisions by Embracing Alternative Futures.

You don’t need to predict futures to prepare for them. By applying Dator’s Growth, Discipline, Transformation, and Decline archetypes, you can challenge assumptions, widen your field of view, and design strategies that hold up under pressure. The payoffs are clear: improved decision agility, higher scenario reliability, stronger leadership alignment, and better risk management.

Four Archetypes Fast Implementation Guide:

Choose a priority decision—market expansion, capital investment, or capability build.

Develop four concise scenarios using the archetypes.

Identify three no-regrets moves and two targeted options per scenario.

Set signposts and review them quarterly to adjust course with confidence.

Embrace the unknown, navigate with agility, and make strategic foresight a repeatable part of how your leadership team decides.

References:

Bezold, Clement. (2009). "Masa Depan Alternatif Jim Dator dan Jalan Menuju Masa Depan Aspiratif IAF." Journal of Futures Studies. 14.

Dator, James. (2009). "Futures Alternatif di Sekolah Manoa", Journal of Futures Studies, 14(2):1-18.

Hines, A. (2014) “Fun with scenario archetypes” https://www.andyhinesight.com/fun-with-scenario-archetypes/